Introduction

Fintech licenses come with limits and many fast-growing players are now turning to banking licenses as a more scalable path forward. Moniepoint is a prime example. It began as a mobile money operator, transitioned to a microfinance bank, and is now pursuing a full commercial banking license. The aim? To overcome regulatory constraints, broaden its service offerings, and go head-to-head with Nigeria’s largest banks.

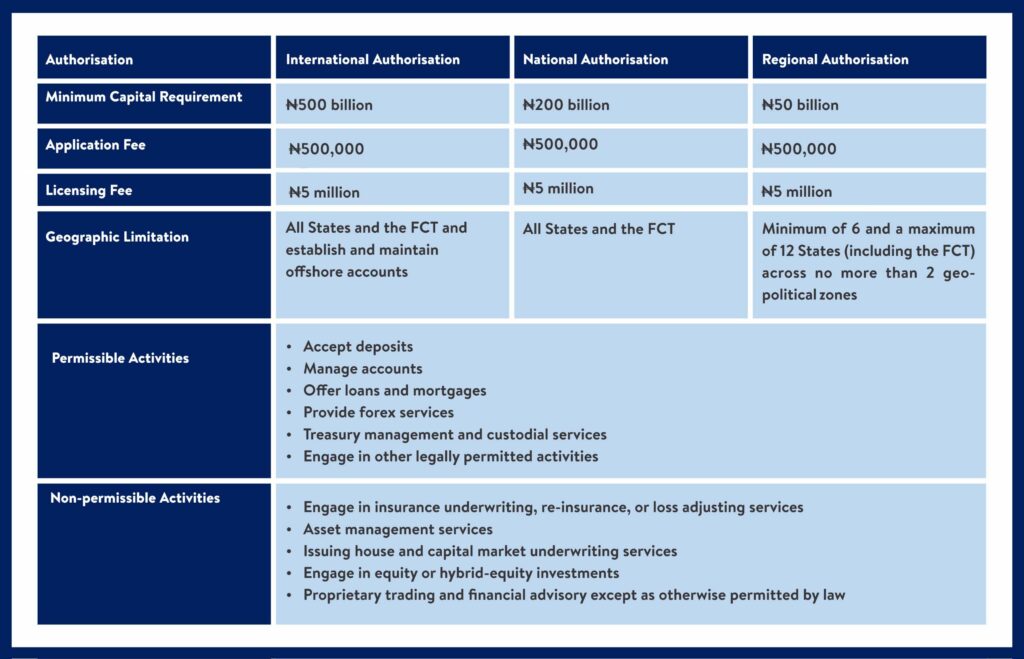

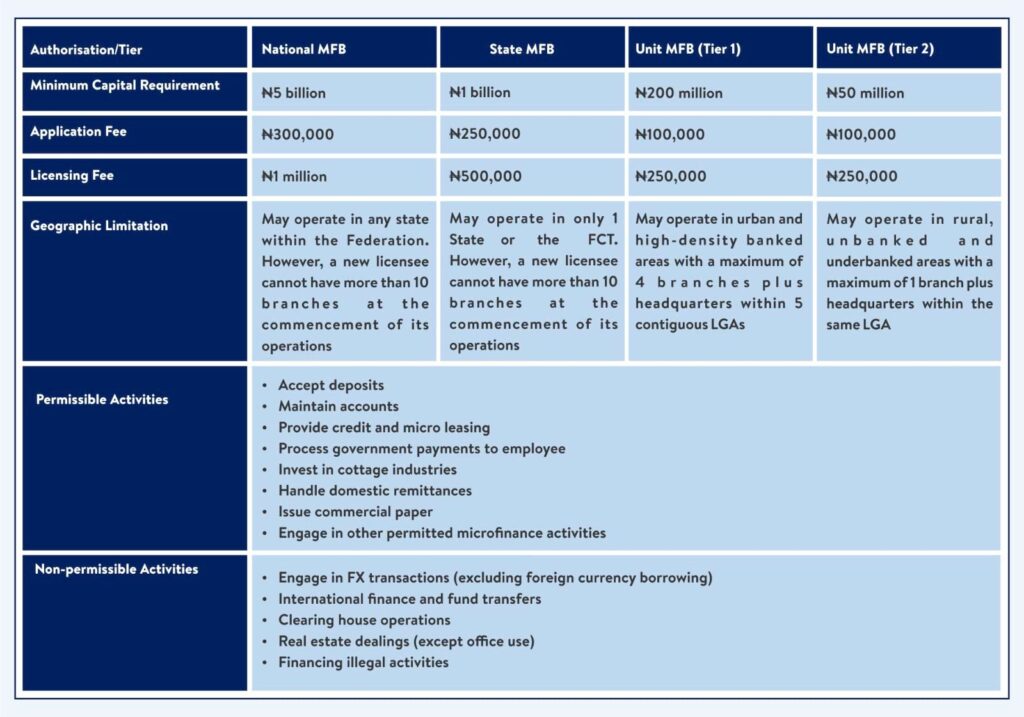

As regulation gets stricter, Moniepoint’s trajectory is fast becoming a playbook for fintechs with long-term ambitions. While there are several banking license options (including merchant and specialised licenses), commercial and microfinance bank licenses stand out as the most popular among fintechs looking to scale. In the tables below, we break down the key requirements, allowed activities, and restrictions for both license types in Nigeria.

Commercial Banking Licenses

The fees and minimum financial requirements quoted in the table are subject to review by the CBN

Microfinance Bank Licenses

The fees and minimum financial requirements quoted in the table are subject to review by the CBN

Conclusion

As fintechs continue to mature and navigate tighter regulations, choosing the right banking license is no longer optional, it’s strategic. Whether aiming for national reach or starting with focused operations, understanding the scope and limits of each license type is essential for sustainable growth. Moniepoint’s journey shows what’s possible when fintechs align ambition with the right regulatory framework.