Introduction

In Nigeria’s increasingly scrutinized and regulated fintech landscape, having a license is no longer enough; it is about understanding what that license permits.

Earlier this year, Paystack reportedly paid a N250 million fine for allegedly offering services via its Zap product outside the scope of its CBN license. That’s not just a compliance slip, it is a strategic setback. Fines like this rattle investor confidence, delay product timelines, and, in some cases, trigger deeper regulatory scrutiny.

Yet, many early-stage founders treat licensing as a bureaucratic box to check, rather than a strategic lens through which to shape their product, pricing, and partnership choices. That’s a risky blind spot.

This Tech Brief distills the key fintech license categories in Nigeria, what they allow, what they restrict, and what founders often get wrong. It’s not a substitute for legal advice, but it is a good starting point for building with regulatory intention.

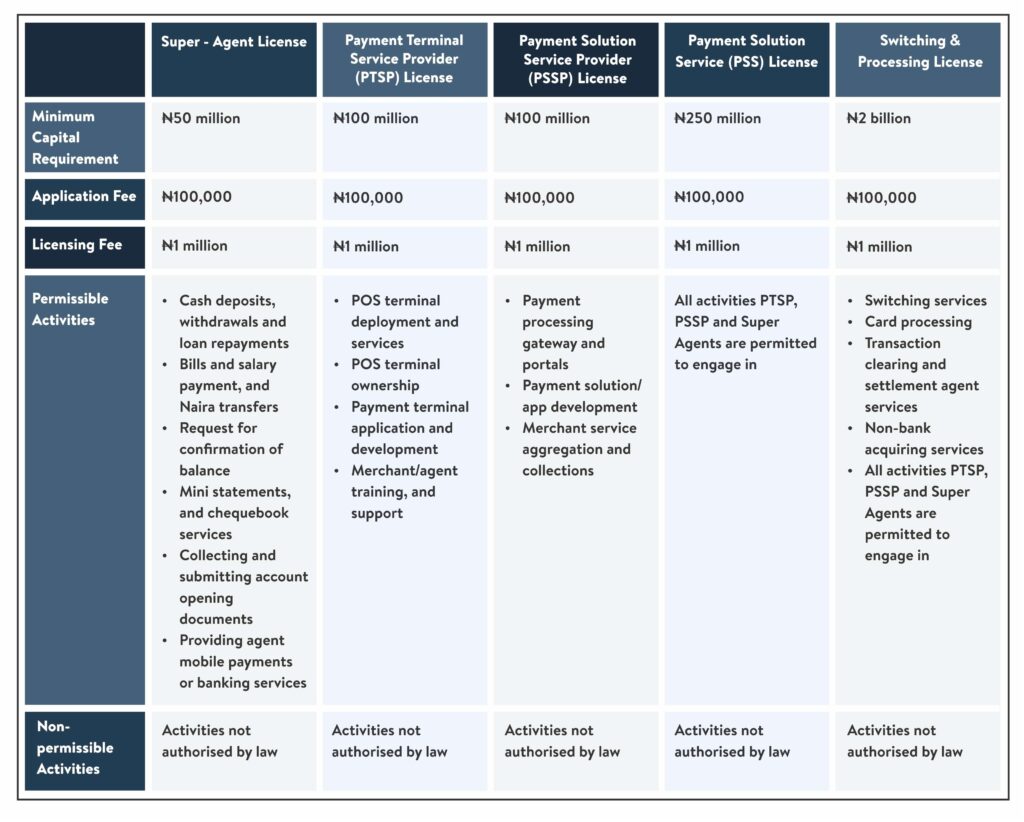

Payment Solution Services Licence (PSS) and Switching & Processing License Categories

The fees and minimum financial requirements quoted in the table are subject to review by the CBN.

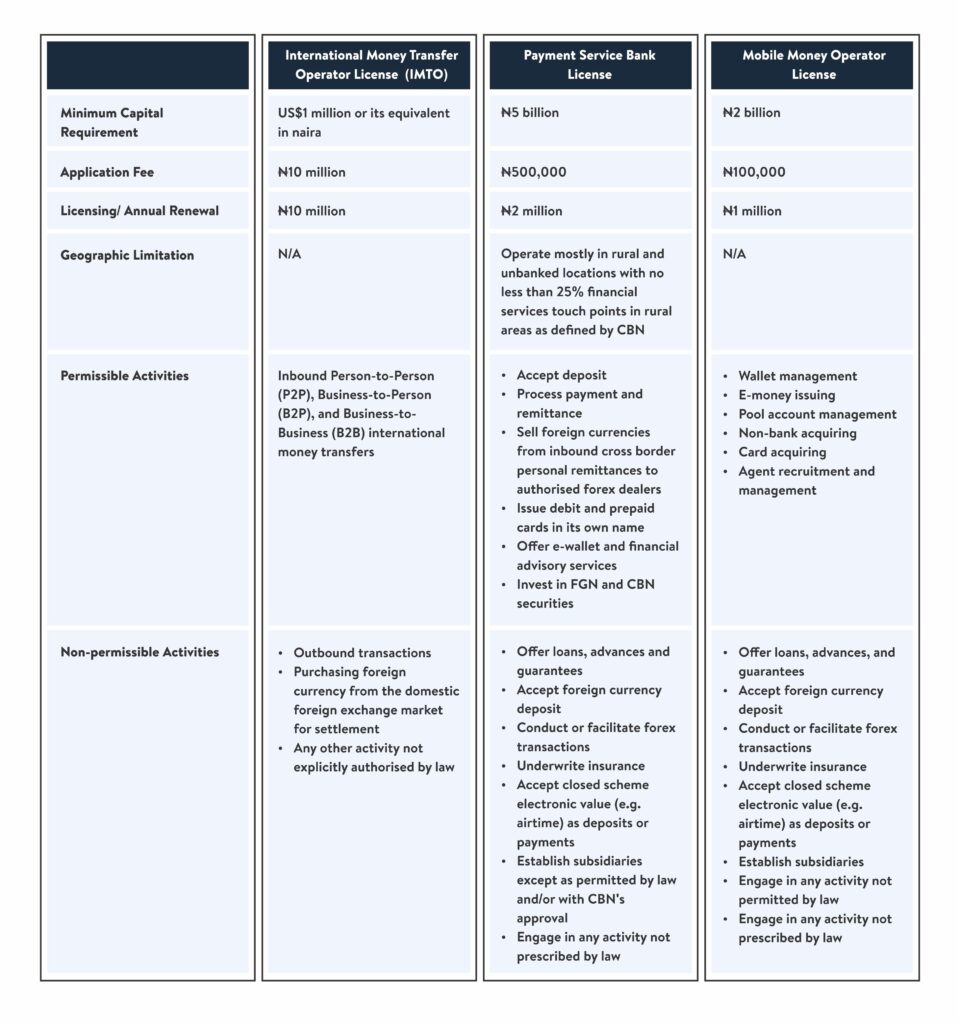

Other Key License Categories

The fees and minimum financial requirements quoted in the table are subject to review by the CBN.

Conclusion

This Tech Brief is designed to serve as a tactical reference, especially for founders navigating licensing decisions while building and fundraising. You can download a copy here for easy reference.

If you are unsure whether your roadmap aligns with your license, now is the time for a regulatory audit. The cost of a wrong assumption is higher than ever.

This article is part of our ongoing series on fintech compliance in Nigeria. Subscribe for more insights on building legally resilient digital financial services. In our next edition, we will go beyond what the law says to what compliance looks like in practice, including common blind spots and how to stay on the right side of the CBN as you scale.